How to Modify Subscription Settings

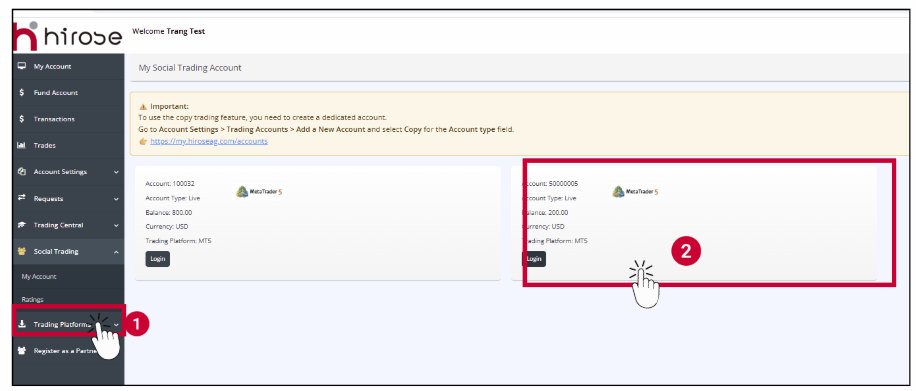

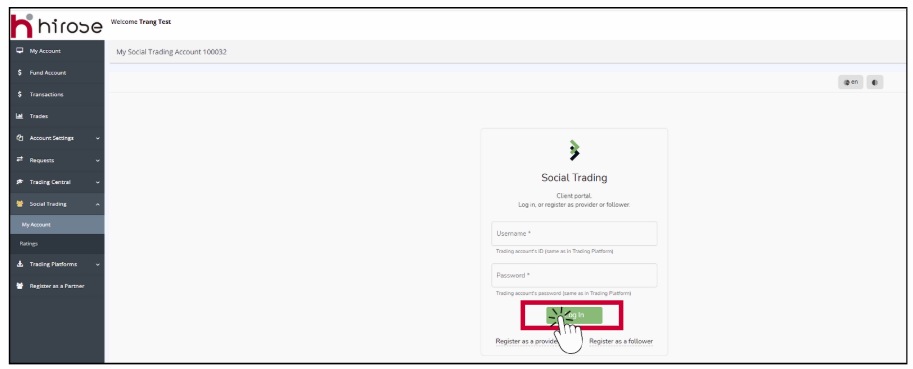

Log in to Social Trading via the Client Portal to monitor your subscription performance.

- User Name: Enter your Trading Account ID (same as in the Trading Platform).

- Password: Enter your Trading Account password (same as in the Trading Platform).

Click Login.

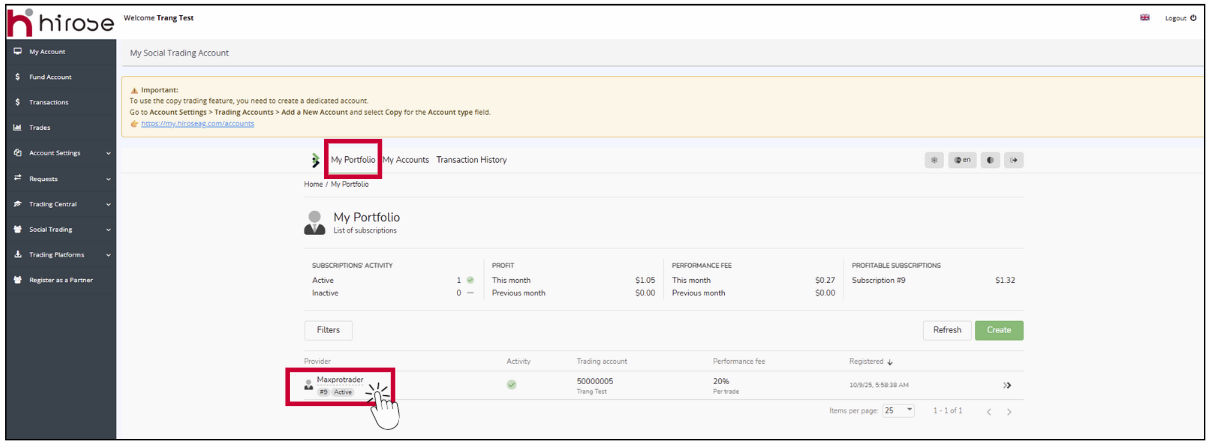

In the first tab, My Providers, please click on your current Provider Profile

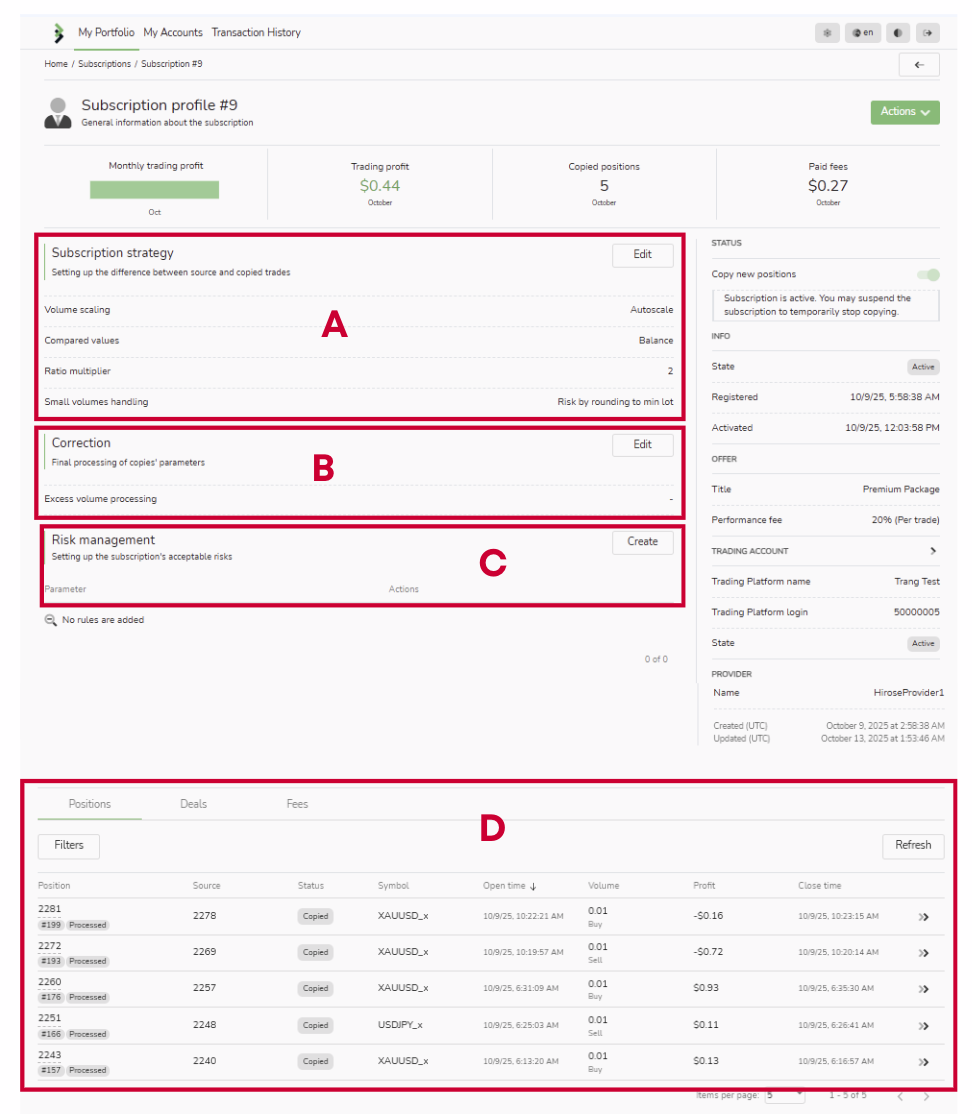

In this section, a follower can set up certain filters for their subscription. They are applied to trades that are about to be opened as a copy from the provider’s original trade. If the provider’s deal doesn’t meet the filters’ conditions, the copy will be skipped. Filters are applied per deal.

ℹ️ NOTE: The filters are applied only to opening deals.

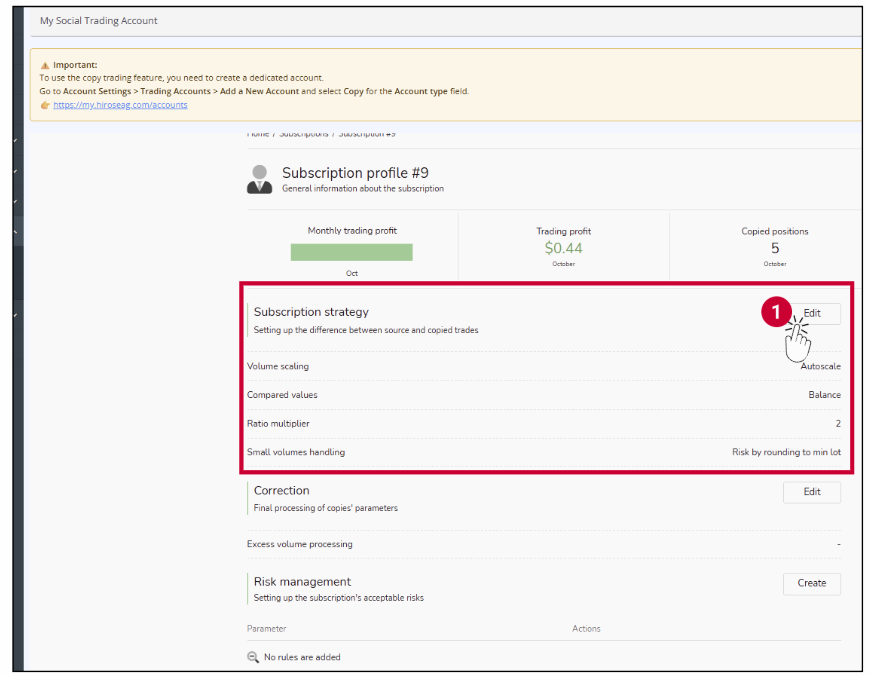

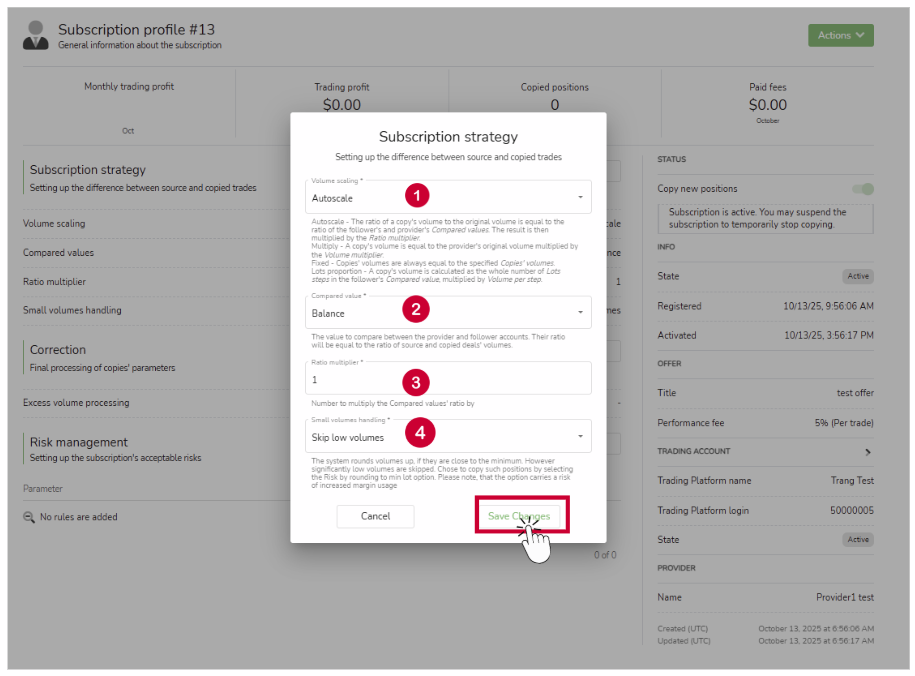

A.SuBSCRIPTION strategy

Setting up the difference between source and copied trades

You can set the differences between source and copied trades:

- 1Volume scaling options

- Autoscale

The copy’s volume must be calculated according to the ratio of follower’s funds to the provider’s funds available on their accounts at the moment of copying. Recommended for followers who know how many funds their provider has.

- Autoscale

- 2Compared Value: Choose Balance or Equity as the base for copied trades.

- 3Ratio Multiplier: Set a number (from 0.01) to adjust copied trade sizes proportionally.

- 4Small Volumes Handling:

- Skip low volumes → Ignore very small trades.

- Risk by rounding to min lot → Round small trades up to the minimum lot.

→ Click Save Changes to save your changes.

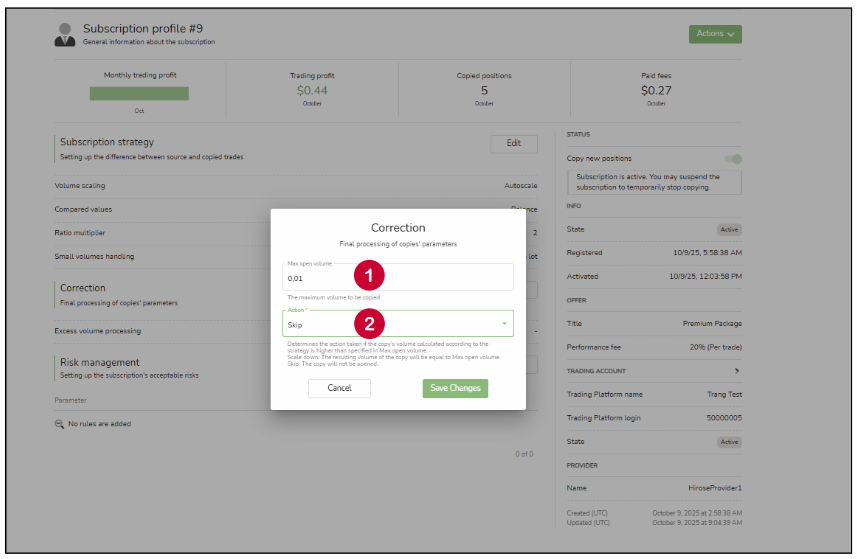

B.Correction

| 1 | Max open volume | Sets a limit for the maximum trade volume. If the calculated volume exceeds this limit, an action will be triggered. |

| 2 | Action | If the limit is reached, the system will either:

|

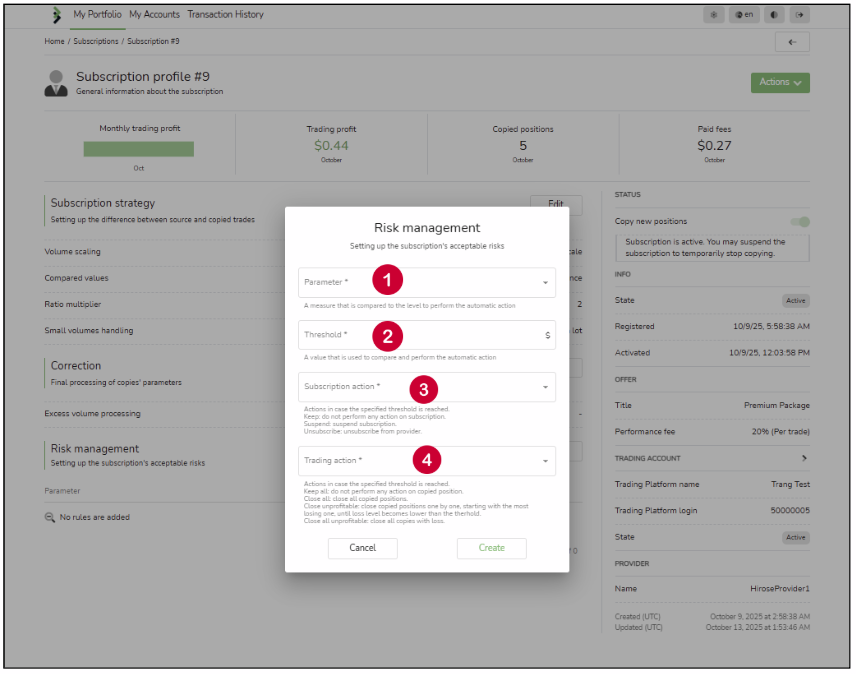

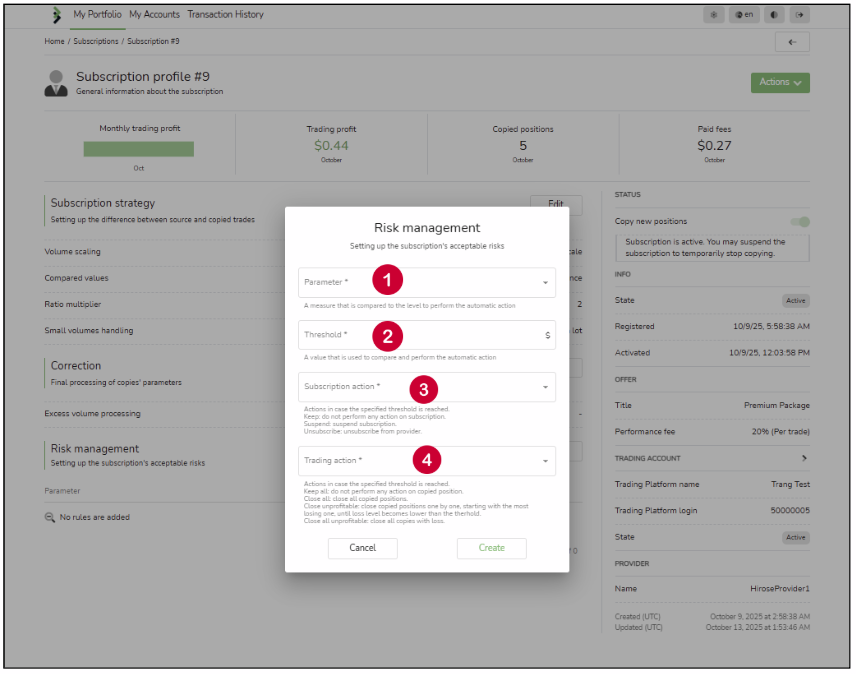

C.Risk Management

Setting up the subscription’s acceptable risks

- 1There are the following stop-level types which can be set up per individual subscription:

- Floating loss level

Triggers if floating PnL of all open copies reaches the specified loss level.

Example:- Position 1’s floating PnL: -$500

- Position 2’s floating PnL: $300

- Floating loss level: 200 ⇒ The action is triggered

- The following action types can be chosen: Close all, Close all unprofitable, Close unprofitable, Keep all + Keep, Suspend, Unsubscribe. If the Keep all trading action and the Keep subscription action are selected, the system does nothing with the subscription and positions, just sends an email notification on the reached level.

- Total loss level

Triggers if realized PnL of all copies since the start of the subscription reaches the specified loss level.

Example:- Position 1’s realized PnL: -$500

- Position 2’s realized PnL: $300

- Total loss level: 200 ⇒ The action is triggered

- The following action types can be chosen: Close all, Close all unprofitable, Keep all + Suspend, Unsubscribe. If the Keep all trading action is selected, the subscription action Keep can be chosen (basically, do nothing with the subscription and positions, just send an email notification on the reached level).

- Total profit level

Triggers if realized PnL of all copies since the start of the subscription reaches the specified profit level.

Example:- Position 1’s realized PnL: $500

- Position 2’s realized PnL: -$300

- Total profit level: 200 ⇒ The action is triggered

- The following action types can be chosen: Close all, Close all unprofitable, Keep all + Suspend, Unsubscribe. If the Keep all trading action is selected, the subscription action Keep can be chosen (basically, do nothing with the subscription and positions, just send an email notification on the reached level).

- Floating loss level

- 2Threshold: Follower’s Risk Management options can be seen as the Stop Loss and Take Profit levels applied to a whole subscription. If the total sum of profits of all the trades copied by the subscription from its provider reaches a certain level called Threshold, the system takes actions on the copies (e.g. closes them automatically) and on the subscription itself (e.g. suspends it). The exact actions can be set up by the follower in the form of rules, the Threshold is specified in the follower account’s currency. There can be only one rule per level type. The system checks periodically if the levels are reached.

- 3Subscription actions

- Keep: Continue copying.

- Suspend: Suspend the subscription.

- Unsubscribe: Archive the subscription.

- 4Trading actions:

- Close all: Close all open copies of the subscription.

- Close unprofitable: Close the most unprofitable open copy of the subscription. Keeps closing unprofitable positions one by one until the total floating loss is within the acceptable floating loss level (works only in this Risk management condition).

- Close all unprofitable: Close all unprofitable copies of the subscription.

- Keep all: Let all open copies of the subscription stay open.

→ Click Create to apply your changes.

D.SuBSCRIPTION strategy

You can view details such as Position, Source, Status, Symbol, Open Time, Volume, Profit, Close Time, and Performance Fee here.

See more: 13-5 How to Monitor Your Subscription Performance

Reasons for Skipped Trades

Such trades are marked as “Skipped” in the Follower’s portal, along with a reason code.

Skipped trades occur when the system detects that copying a specific deal violates one or more subscription parameters or platform rules.

- Symbol filtered: the provider’s symbol is not allowed by the subscription filter.

- Direction filtered: the trade’s direction (Buy/Sell) was excluded by the follower’s filter.

- Volume too low / below minimum lot: the calculated copy volume was smaller than the minimum tradable size.

- Max open volume reached: the volume exceeded the maximum limit defined in Correction settings.

- Provider trade not tracked: the provider’s position was not eligible for copying (e.g., Out-only mode).

These reasons are displayed in the Skip column of the follower’s portal for transparency.

Email notifications for skipped trades are not sent automatically, unless specifically configured by the broker.

Are you ready? Let’s get started!