Hirose:

Making Trust Visible.

What Makes a Company You Can Entrust with Your Valuable Assets?

There are many companies that allow you to trade FX (foreign exchange) online.

But have you ever felt unsure, wondering,

“Is this company really safe, especially since it’s new in Vietnam?” or “Will they really protect my money properly?”

At times like these, what matters most is whether there is a solid basis for trust.

On this page, we’ll clearly explain why so many traders choose Hirose and why you can trust us with your valuable assets.

“Why Over 700,000 Clients in Japan

and

Around the World Have Chosen Us for 20 Years”

At Hirose, we offer three key assurances: performance, asset management, and financial stability.

What proves these assurances is the credit ratings from independent external agencies, which make our trustworthiness visible.

What is a Credit Rating?

“Will this company really return my money properly?”

“Is there a risk it might suddenly go bankrupt?”

A credit rating is a system that makes it easy to understand a company’s creditworthiness (how trustworthy it is) by having specialized agencies evaluate and present it in the form of scores or ranks.

To put it simply, it’s like a character strength score in a game or a school report card.

By just looking at the score or rank, you can judge, “This company is reliable,” or “Maybe I should be cautious here.”

Major Credit Rating Agencies

| Agency Name | Country | Features | Main Users | Notes |

|---|---|---|---|---|

| S&P Global Ratings | USA | The largest globally; covers corporations, governments, and all types of financial products | Banks, investors, governments | Used to assess government and corporate bonds worldwide |

| Moody’s Investors Service | USA | Especially strong in sovereign and public sector ratings; highly influential in bond markets | International organizations, investors | Strong in analyzing default risk |

| Fitch Ratings | USA / UK | Known for a flexible perspective among the “big three”; strong in corporate and financial institution ratings | Banks, corporates, investors | Provides a more flexible viewpoint compared to other major agencies |

| JCR (Japan Credit Rating Agency) | Japan | Specialized in evaluating Japanese companies and local governments; high expertise in Japanese market | Japanese investors, local governments, corporations | Strong analytical capabilities for Japanese market and companies |

These agencies are internationally recognized and serve as a “trust benchmark” used by investors, banks, and governments.

Unlike simple surveys or online reviews, credit rating agencies thoroughly evaluate a company’s credibility based on internal information.

It is an important indicator that affects not only a company’s credibility but also its stock price and ability to raise funds.

Even a single notch change in rating can trigger a significant reaction across the entire market.

Major investors place high importance on credit ratings

A high credit rating → perceived as safe → investors feel confident buying shares → stock prices rise.

A lower credit rating → perceived as risky → more investors may sell → stock prices fall.

Impacts not only stock prices but also borrowing costs

A higher credit rating means lower borrowing costs, making it easier to generate profits.

Conversely, a lower rating increases interest burdens, which negatively affects stock prices as well.

Why Are Credit Rating Agencies Considered “Fair”?

Evaluated from a third-party perspective

Credit rating agencies are not part of any bank, corporate group, or government body.

They act as independent third-party professional organizations that evaluate from a neutral standpoint.

This ensures evaluations are not adjusted to suit a company’s interests, but rather judged objectively based on “what can be trusted.”

Universal evaluation standards

S&P, Moody’s, Fitch, and JCR all conduct evaluations based on internationally recognized rules and standards.

For example: they analyze detailed financial figures such as revenue, profits, and debt, and verify risk management and governance.

All companies are compared using the same criteria, which makes the process fair.

Registered and supervised

by financial authorities

Credit rating agencies are officially registered with national or regional financial authorities.

Because they are regulated, they cannot give arbitrary or biased ratings.

They are strictly supervised, and any misconduct would immediately become a major problem.

Long track record and global trust

The evaluations by credit rating agencies are actually used in global finance, such as for government bonds, corporate bonds, and loans.

If their evaluations were biased, no one would trust their ratings anymore.

Their continued trust and long history itself serve as “proof of fairness.”

What’s Required to Receive a Credit Rating

First, a company must apply for a rating.

A rating is not automatically assigned; the company itself applies to a rating agency and signs a contract.

Documents submitted to the rating agency

To receive a rating, a company must submit a large amount of information. Based on these, the rating agency conducts a thorough review.

| Required Documents | Content | Why Needed? |

|---|---|---|

| Financial statements | Balance sheets including revenue, profit, debt, cash flow, assets, etc. | To understand the flow of money within the company |

| Business plans | Future growth plans and strategies | To judge whether stable profits can be achieved |

| Governance information | Management structure and internal rules | To verify management soundness |

| Risk management materials | Crisis preparedness, insurance, internal control systems | To assess readiness for unexpected situations |

Meetings and interviews

Representatives from the rating agency meet with the management team.

They also check on qualitative factors that are not reflected in numbers, such as “mindset” and “management attitude.”

Ongoing monitoring

Even after a company receives a rating, it is generally reviewed annually.

If performance improves, the rating can be upgraded; if it worsens, it may be downgraded.

To obtain a credit rating, only sound and trustworthy companies that can fully disclose their information can pass the evaluation.

Having a credit rating itself becomes a strong reassurance that proves a company’s credibility.

Credit Rating Agency Evaluation Levels

Although there are many rating levels, the major global credit rating agencies use mostly similar structures.

| Credit Level | S&P | Moody’s | Fitch | JCR | Description |

|---|---|---|---|---|---|

| Highest Rank (Top Class of Safety) | AAA | Aaa | AAA | AAA | Extremely high creditworthiness. The safest top-level rating under any circumstances. |

| Very High Creditworthiness | AA+, AA, AA− | Aa1, Aa2, Aa3 | AA+, AA, AA− | AA+, AA, AA− | Excellent stability. Almost the same level of reliability as AAA. |

| High Creditworthiness | A+, A, A− | A1, A2, A3 | A+, A, A− | A+, A, A− | High creditworthiness and stability. Companies can be supported with confidence. |

| Stable Creditworthiness | BBB+, BBB, BBB− | Baa1, Baa2, Baa3 | BBB+, BBB, BBB− | BBB+, BBB, BBB− | Adequate creditworthiness. Considered a relatively safe investment under normal operations. |

| Growth Potential Zone | BB+ and below | Ba1 and below | BB+ and below | BB+ and below | In the growth stage, with potential for future upgrades. |

| Weak Area | CCC, CC | Caa, Ca | CCC, CC | CCC, CC | High risk unless conditions improve. Often requires external support. |

| Highly Challenging | C | C | C | C | Extremely limited repayment ability. Subject to restructuring efforts. |

| Default | D/SD | — | D | D | Already in default. In stages where restructuring or rehabilitation is being considered. |

Vietnam’s Government (Sovereign) Credit Rating: “BB+”

Vietnam’s Government (Sovereign) Credit Rating: “BB+”

Currently, Vietnam’s government (sovereign) credit rating is “BB+.”

This means the country is just below investment grade and is considered “in a phase of growth.”

In fact, Vietnam is attracting global attention today for several reasons:

・High economic growth rate, even within Asia

・Young and vibrant population

・Development as a manufacturing and export hub

・Continuous increase in foreign direct investment (FDI)

In other words, the “BB+” rating indicates that Vietnam is “still in the development stage, but with great potential.”

This rating is determined not only by current safety, but also by considering future growth potential.

Vietnam is expected to move up to “investment grade” in the future as its economy continues to grow.

Right now, it is truly in the “growth stage.”

Major Credit Ratings of Vietnamese Banks

| Bank Name | Rating Agency | Long-term Rating | Outlook | Comment |

|---|---|---|---|---|

| Vietcombank | S&P | BB | Stable | Recognized for both stability and growth |

| BIDV | Moody’s | Ba2 | Stable | Rated highly for strong government support, deposit volume, and liquidity |

| Agribank | Fitch | BB+ | Stable | Operates reliably as Vietnam’s largest state-owned bank |

| VietinBank | Moody’s | Ba2 | Stable | Evaluated as a major state-owned bank closely related to agriculture and forestry |

The “BB+ / Ba2” ratings indicate stable operations and future growth potential, suggesting low immediate risk.

As major state-owned or quasi-state-owned banks, they benefit from strong national support and liquidity.

From a customer perspective, Vietnam’s major banks can be seen as reliable and solid choices.

What is Hirose’s Rating?

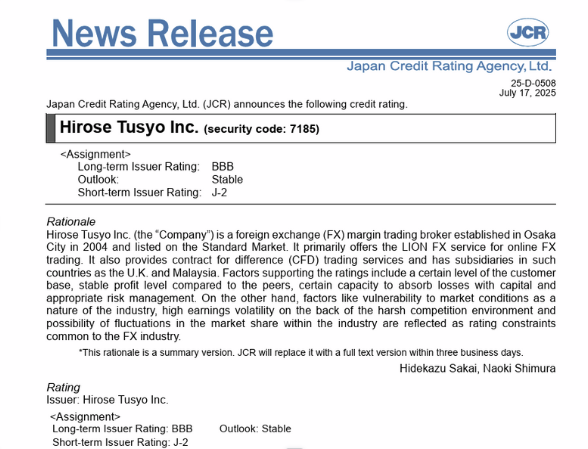

Hirose has consistently received a high rating of “BBB” from Japan Credit Rating Agency (JCR) for over 10 years.

This “BBB” rating serves as third-party proof that “the company manages funds properly and operates in a stable and trustworthy manner.” For more information, click here ➤

Additionally, Hirose was awarded the high short-term credit rating of “J-1,” demonstrating its strong ability to safeguard clients’ funds properly.

At JCR, creditworthiness is evaluated using the following ranking system:

- AAA

- Highest grade (very safe)

- AA

- Very high creditworthiness

- A+

- High creditworthiness

- BBB

- Moderate safety and caution advised

- J-1

- High short-term payment ability

Hirose has maintained a high and stable rating over a long period.

This also serves as proof of its financial soundness and strong management.

Why Choose Hirose

📈 Over 20 years of proven track record

💰 Secure fund management with trusted custody

📄 Monthly disclosure of risk and financial information

🛡️ “Trustworthiness” proven by credit rating achievements

For First-Time Customers

“Is this company really safe and reliable?”

It’s natural for anyone to feel this way at first.

That’s why Hirose has built trust through “numbers” and “results.”

For our customers in Vietnam as well,

we will continue to operate transparently and stably to remain “a place where you can safely entrust your valuable funds.”

Our long history of strong ratings and consistently sound operations are key reasons why first-time customers can choose us with confidence.