Forex Academy:

Primary School

5 minutes

Lesson 2

What is a currency pair?

- What is a currency pair?

- Why do currency pair exchange rates fluctuate?

- Which currency pair should I trade?

What is a currency

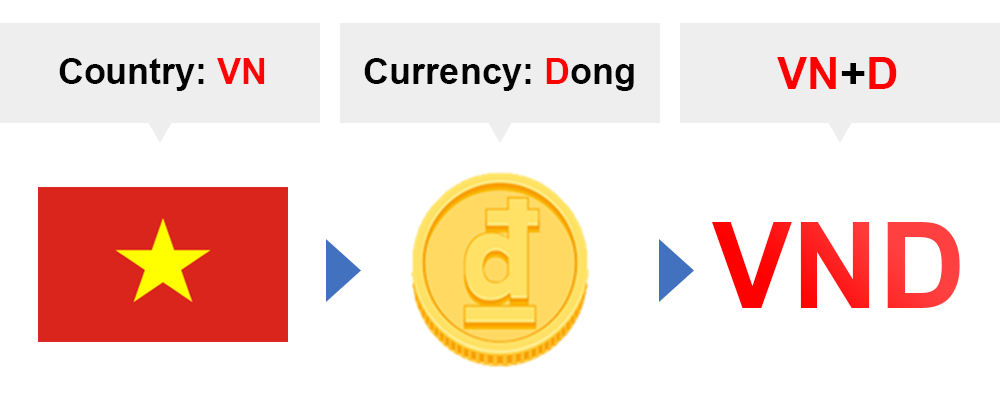

Currency is the money used in different countries.

For example, the currency of Vietnam is the Vietnamese Dong.

In the Forex market, you will trade currency pairs.

For example: The currency of the United States is the US Dollar. It is represented by the 3-letter abbreviation USD.

The currency of Vietnam is the Vietnamese Dong. It is represented by the 3-letter abbreviation VND

When you pair two currencies together, you get a currency pair.

Have you ever seen information about currency pairs on breaking news ?

In the image below, you can see currency pairs displayed in the bottom of the news screen (the reporter position).

The meaning of USD/IDR 14.166,80 in the news broadcast above is:

Currently, the price of 1 USD is equal to 14.166,80 IDR.

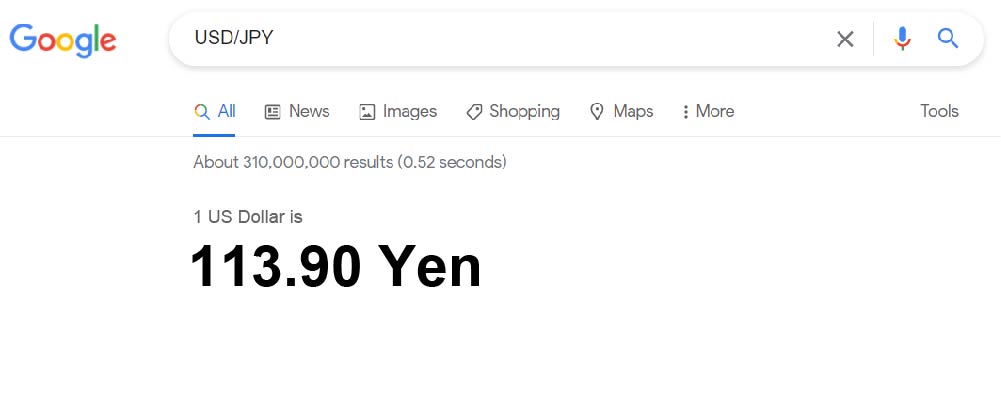

Or when I try typing USD/JPY and search on Google, the result I get is 113.90 Japanese yen.

This means that …

Currently, the price of 1 USD is equal to 113.90 Japanese Yen.

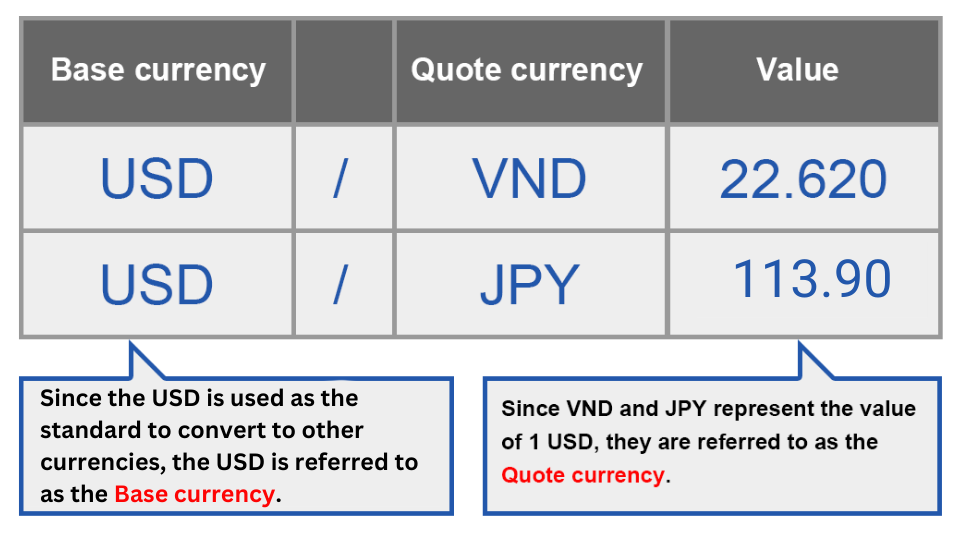

Do you recognize a common point? Yes, you are very observant!

USD/JPY and USD/VND

both represent the value of the Japanese Yen and Vietnamese Dong respectively against 1 USD

I have summarized the content in the table below for you.

If you own Vietnamese Dong and want to have USD,

You can pay 22,620 VND to recieve 1 USD at the foreign exchange counter.

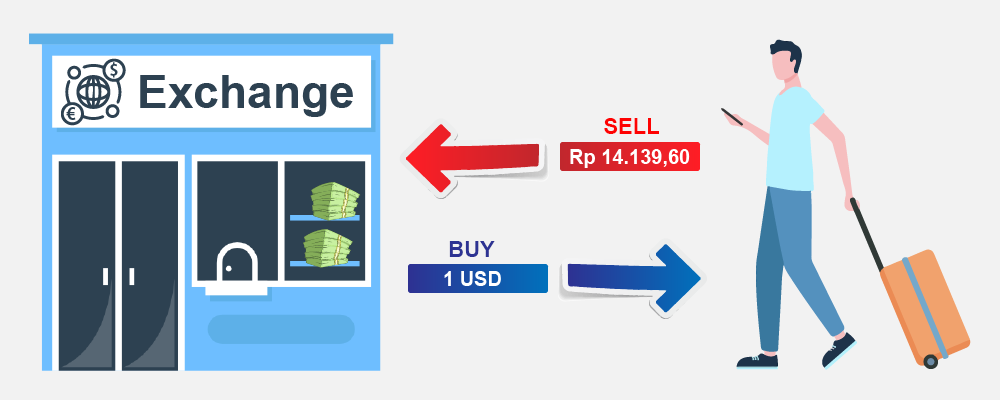

IMPORTANT KNOWLEDGE

In the Forex market,

Receiving 1 USD means you are Buying 1 USD

Paying 14.139,60 IDR means you are Selling 14.139,60 IDR

Please remember this!

Why do exchange rates of currency pairs fluctuate?

There are various factors that can cause prices to fluctuate. But the reality is that you don’t need to know all the factors in order to profit from Forex trading.

Let’s explore the following basic factors.

The fluctuations in currency exchange rates are determined by the relative power dynamics between the two countries.

The currency of the stronger country has a higher value, while the currency of the weaker country has a lower value.

Example 1:

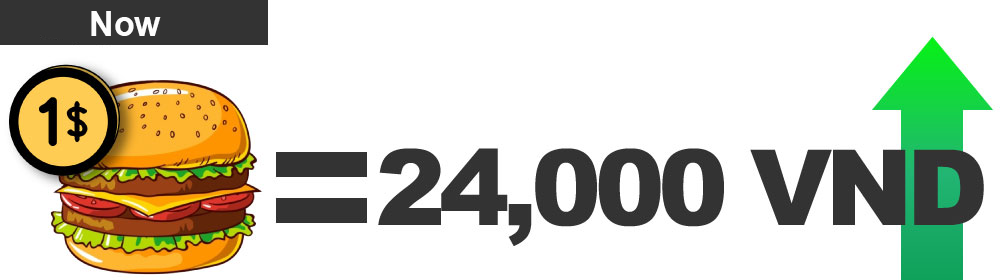

If the US economy is relatively stronger than Vietnam’s, the USD/VND exchange rate will increase.

You can buy a McDonald’s hamburger in the US for $1, which is equivalent to 23,000 VND.

When the US economy is doing better, the US dollar has become stronger compared to the Vietnamese Dong.

Previously, you could buy a hamburger for 23,000 VND,

but now you have to buy it for 24,000 VND.

Example 2

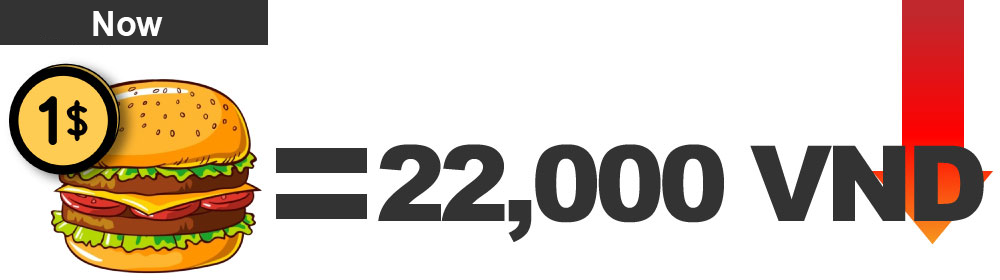

If the Vietnamese economy is relatively stronger than the United States, the USD/VND exchange rate will decrease.

You can buy a McDonald’s hamburger in the US for $1, which is equivalent to 23,000 VND.

When the Vietnamese economy is doing better, the Vietnamese Dong has become stronger compared to the US dollar.

Previously, you could buy a hamburger for 23,000 VND, but now you can buy it for 22,000 VND.

Remember that the stronger country has a “higher currency value” and the weaker country has a “lower currency value”.

So you can see that events affecting the relative power dynamics between the two countries all impact the fluctuations in the exchange rate.

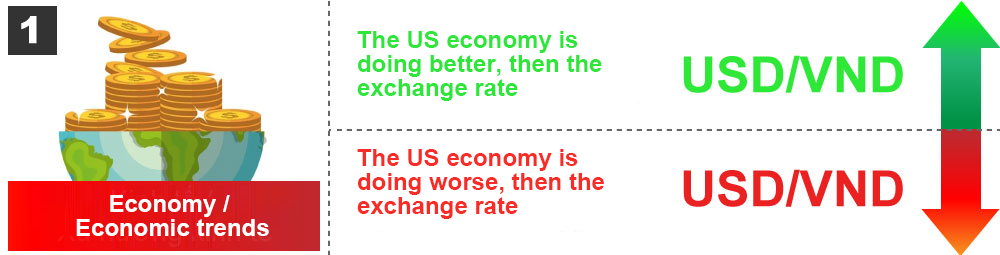

The key events that influence the exchange rate are as follows:

If a country’s economy becomes stronger, the value of its currency becomes higher, and if it becomes weaker, the value of its currency becomes lower.

The US Non-Farm Payrolls report at 7:30 PM on the first Friday of every month is a major event that measures the number of jobs added or lost in the economy, excluding farm workers, government employees, private household employees, and nonprofit organization employees. The release of this report causes significant price fluctuations. If domestic employment numbers increase, the US dollar price will rise, and if domestic employment numbers decrease, the price will fall. This time period is a great opportunity to make profits, so be sure to log in and trade!

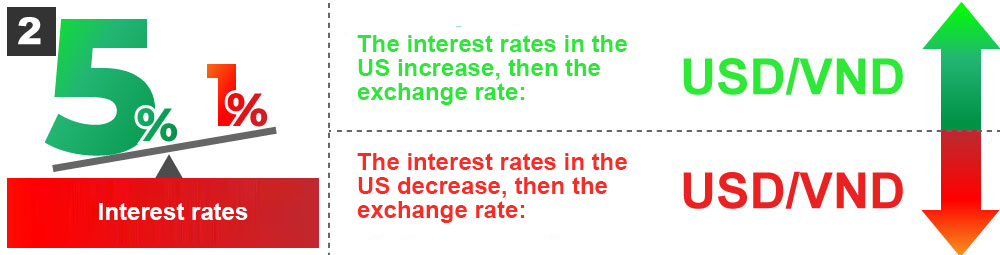

Imagine that you deposit savings in a bank.

Country A has announced an interest rate of 5%, while Country B will have an interest rate of 1%.

You can see that the 5% interest rate of Country A is higher than the 1% interest rate of Country B.

Clearly, the interest rate of Country A is more favorable as you get a higher return on your savings than if you invested in Country B, where the return would be lower due to the lower interest rate.

The difference in interest rates between the two countries also contributes to price fluctuations. In this case, the currency of Country A will be higher in value than the currency of Country B.

The US FOMC (Federal Open Market Committee) meeting, which takes place at 18:30 AM (GMT) at the beginning of each month, will determine the domestic interest rate. If the interest rate increases, the US dollar price will rise, and if the interest rate decreases, the US dollar price will fall. This time period is a great opportunity to make profits, so be sure to log in and trade!

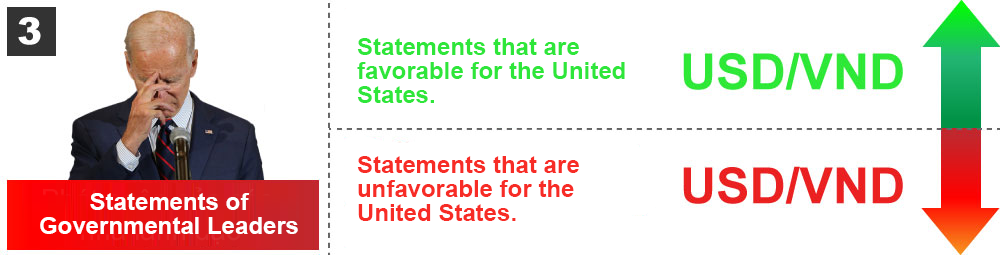

The statements made by governmental leaders also affect prices. For example, recently the US President said, “Russia is the aggressor that invaded Ukraine first, and we will begin additional sanctions.” As a result, the US dollar has weakened, with a pessimistic outlook that the war will continue.

So, which currency pair should I trade?

Let’s compare the two following markets:

You can see that the market on the left is bustling with many customers.The market on the right is stagnant with few buyers and sellers.

Question:

Between the bustling market and the stagnant market, do you know where it would be better to trade?

Answer:

The key is to choose an active market (currency pairs) where there are many traders.

There are many people = There are many transactions = Large trading volume will bring the following benefits:

1. When the trading volume is large, you can more easily recognize the trends of the market, making it relatively easier for you to analyze the market situation.

2. If the trading volume is large, the transaction cost will be lower.

For example, if there was only one rice store in the whole world, what would it be like? Everyone really likes rice and there is always a high demand for rice, so the store can arbitrarily decide the selling price.

But if the number of stores increases to 2, 3, 4, 1,000, 10,000, what would it be like? That’s right, competitiveness in the market will increase. Therefore, the stores will not be able to decide the selling price on their own and will instead set their prices more closely to competitors, lowering the price of rice in the market.

If the trading volume is large, the market will be more stable, so you can trade with confidence.

We will explain the transaction costs to you in lesson 5.

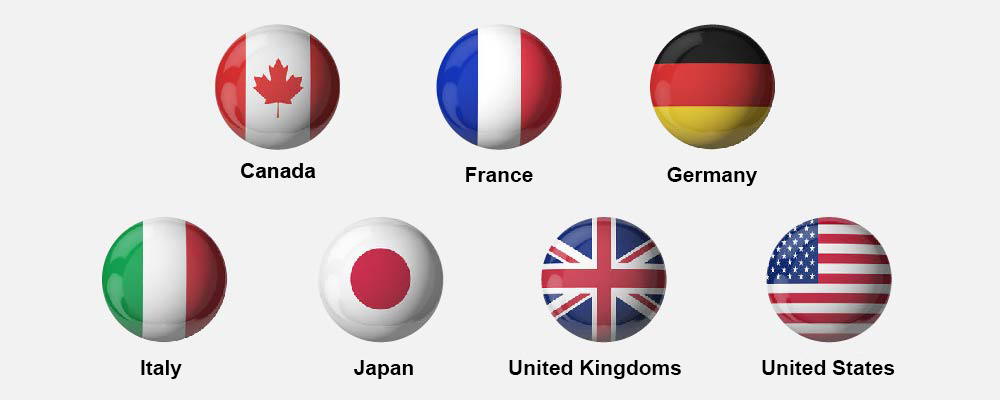

More specifically, you should choose a currency pair that includes the currency of a G7 country, the world’s largest economic powers with the highest trading volume.

EUR/USD, USD/JPY, EUR/JPY, GBP/USD, USD/CAD, EUR/GBP…..

Among those currency pairs, we particularly encourage you to trade the currency pairs listed below!!!

EUR/USD, USD/JPY

These are the 2 most actively traded currency pairs in the world.

At Hirose, you can trade Forex 24 hours a day on your phone or computer without having to go to a currency exchange counter.

The lesson on “Currency Pairs” ends here. If you have any questions, please feel free to contact us.

Let’s check to see if you understand the lesson!

In the next lesson, we will guide you on “When depositing funds in Vietnamese Dong, is it possible to trade other currency pairs?”

Please continue to follow along. If you have any questions, please feel free to contact us.