Forex Academy:

Middle School

5 minutes

Lesson 8

Do you need to constantly monitor

the trading platform?

- Why is it unnecessary to monitor your trading platform constantly?

- What is market forecast? How to view market forecast?

- Introducing a convenient way to place orders

(Pending orders)

Why is it unnecessary to monitor your trading platform constantly

We frequently receive the following question from customers:

“Do I need to constantly monitor the trading platform to trade?”

I can provide you an answer: You do not need to do so.

I believe that all of you who have followed Lesson 8 understand the following:

The simple principle to profit in trading is to buy low and sell high.

That means:

All you need to do is identify opportunities to “buy low, sell high.”

Assuming the Forex chart moves like an electrocardiogram

Because the chart constantly goes up and down unexpectedly,

if you don’t regularly look at the chart, you may miss opportunities.

Regardless of the time you access the platform during the day, you can still buy low, sell high, and make a profit.

This chart is from the MetaTrader 4 platform by Hirose, and the time interval from left to right is 10 minutes.

Within just 10 minutes, you have the opportunity to buy low, sell high, and make a profit.

Next, to enable even beginners to profit in the short term,

I would like to introduce our market forecast.

The market forecast is published daily on Facebook at 10:30 AM Vietnam time on weekdays.

What is market forecast? How can I view the market forecast?

Regardless of the time you access the platform during the day, you can still buy low, sell high, and make a profit.

I understand that principle, but how do I know whether to place a buy or sell order?

In conclusion:

You don’t have to guess whether to place a buy or sell order.

We will let you know.

Market forecast is a precise analysis conducted by Japanese forex experts.

The market forecast is provided exclusively to Live account customer at Hirose.

Please contact HIROSE VIETNAM via Zalo to receive information about the market forecast.

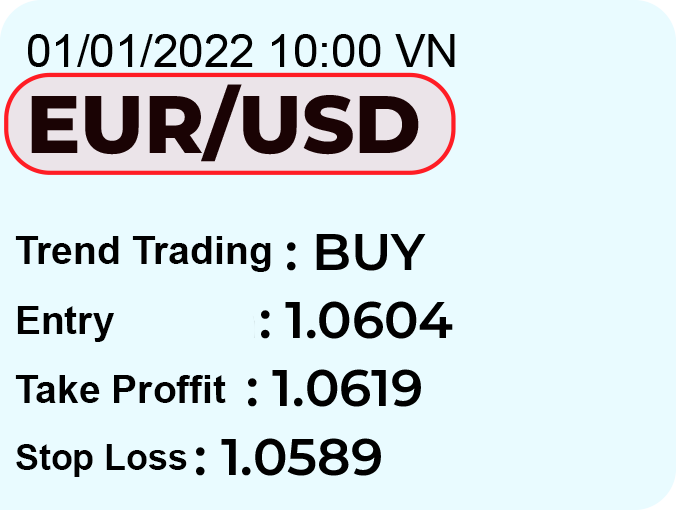

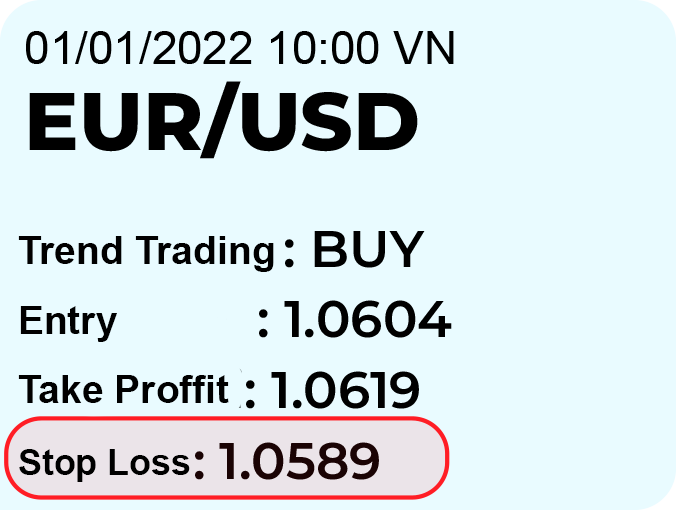

Step 1 : Identify the recommended trading pair.

The currency pair featured in the daily market forecast is the currency pair with a high chance to take profit.

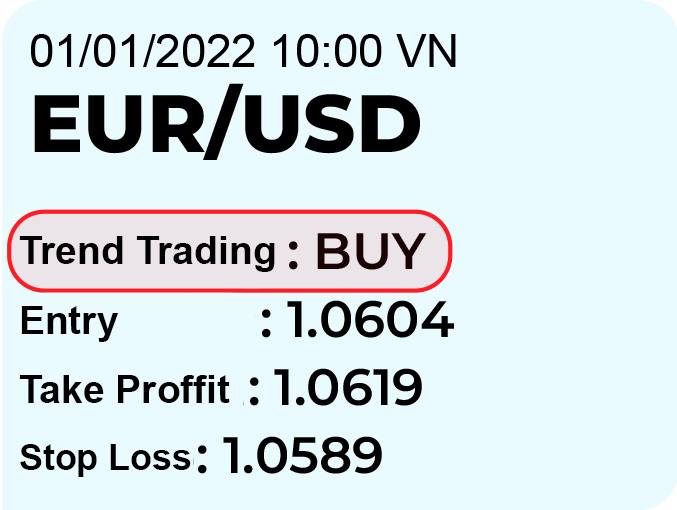

Step 2 : Determine the price direction.

The forecast about whether the price of the trading pair will increase or decrease during the day will be indicated.

If the forecast is BUY, it means the price is expected to rise.

If the forecast is SELL, it means the price is expected to fall.

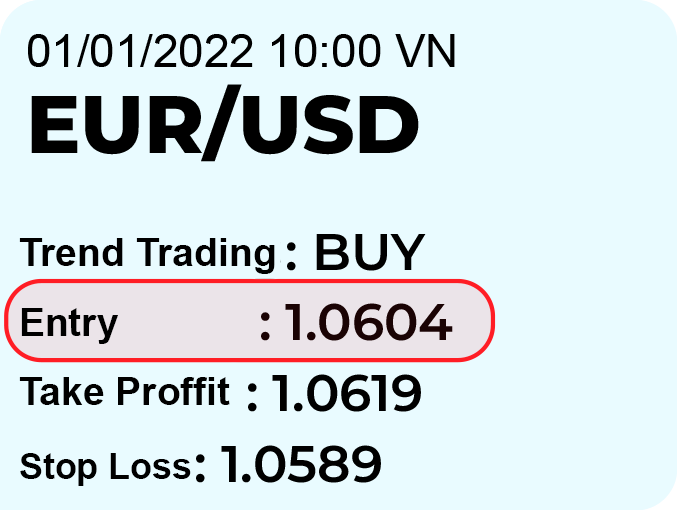

Step 3 : Determine the entry price.

The price listed under the “Entry” section is the designated entry price.

For example, if the order is BUY and the Entry price for EUR/USD on that day is 1.0604, you should place a Buy order when the price reaches 1.0604.

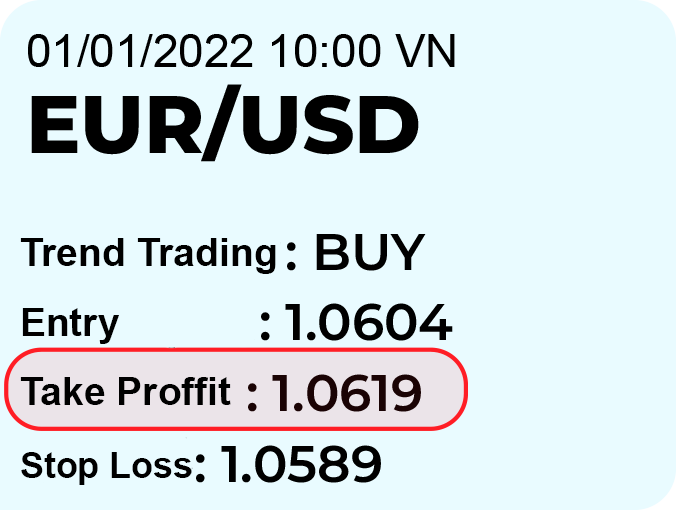

Step 4 : Determine the take profit price to secure profits.

If the market price reaches the Take Profit level, we encourage you to close the order to secure your profits.

Step 5 : Determine the stop loss price to limit losses.

If the market price reaches the Stop Loss level, we recommend closing the order to limit your losses.

Regardless of the time you access the platform during the day, you can still buy low, sell high, and make a profit.

Introduce the convenient order placement method (Pending Order)

Lastly, I will introduce a very useful order placement method for busy individuals.

This is a weekly chart of the USD/JPY currency pair.

It’s an ideal chart when the price is gradually increasing.

If you can buy and sell at the marked red positions, the profits can be significant!

Even with a minimum trading volume of 0.01 lot, you can still achieve a profit of nearly 20$.

In reality, in Forex, there is a method of placing orders that allows you to buy and sell automatically at any price you desire.

That method is called:

Limit Order

This order placement method is also very convenient for busy individuals who have work and household responsibilities and don’t have much time to monitor the trading screen.

If the exchange rate reaches the price you have set in advance, the trade order will be automatically placed.

In the next login, you may find that your account balance has increased since then.

I will use an example of the USD/VND currency pair to explain it to you.

1.The current exchange rate is 22.700.

2.When the exchange rate falls from 22.700 to the expected price of 22.000, the buy order will be automatically executed.

3.Next, when the exchange rate rises to 23.000, the sell order will be automatically executed.

The difference between these prices is the profit!!

All you need to do is log in to the trading platform and place a limit order. Even if you log out, the trade will be automatically executed, so the entire process takes less than 5 minutes.

Click on the videos below to learn how to set up Pending Orders!!

For MetaTrader 4 platform on PC

1. Setting up a buy limit order

This video guides you through the process of setting up a buy limit order on MetaTrader 4 platform for PC

2. Setting a Take Profit Order for a Buy order

This video guides you through the process of setting up a take profit order for a Buy order on MetaTrader 4 platform for PC

For MetaTrader 4 platform on Android version

1. Setting up a buy limit order

This video guides you through the process of setting up a buy limit order on MetaTrader 4 platform for Android version

2. Setting a Take Profit Order for a Buy order

This video guides you through the process of setting up a take profit order for a Buy order on MetaTrader 4 platform for Android version.

The lesson on “Do you need to Constantly Monitor the Trading Platform?” ends here!

Let’s check quiz if you have understood the lesson or not!

In the next lesson, we will provide you with information about “How to close Buy and Sell positions”.

Please continue to follow along.

If you have any questions, please feel free to contact us.